1990. China's economy has come to a halt. The Economist

1996. China's economy will face a hard landing. The Economist

1998. China's economy’s dangerous period of sluggish growth. The Economist

1999. Likelihood of a hard landing for the Chinese economy. Bank of Canada

2000. China currency move nails hard landing risk coffin. Chicago Tribune

2001. A hard landing in China. Wilbanks, Smith & Thomas

2002. China Seeks a Soft Economic Landing. Westchester University

2003. Banking crisis imperils China. New York Times

2004. The great fall of China? The Economist

2005. The Risk of a Hard Landing in China. Nouriel Roubini

2006. Can China Achieve a Soft Landing? International Economy

2007. Can China avoid a hard landing? TIME

2008. Hard Landing In China? Forbes

2009. China's hard landing. China must find a way to recover. Fortune

2010: Hard landing coming in China. Nouriel Roubini

2011: Chinese Hard Landing Closer Than You Think. Business Insider

2012: Economic News from China: Hard Landing. American Interest

2013: A Hard Landing In China. Zero Hedge

2014. A hard landing in China. CNBC

2015. Congratulations, You Got Yourself A Chinese Hard Landing. Forbes

2016. Hard landing looms for China. The Economist

2017. Is China's Economy Going To Crash? National Interest

2018. China's Coming Financial Meltdown. The Daily Reckoning.

2019. China's Economic Slowdown: How worried should we be? BBC2020. Coronavirus Could End China's Decades-Long Economic Growth Streak. NY Times

2021. Chinese economy risks deeper slowdown than markets realize. Bloomberg

2022. China Surprise Data Could Spell R-e-c-e-s-s-i-o-n. Bloomberg.

2023. No word should be off-limits to describe China's faltering economy. Bloomberg

2024. China Slowdown Means It May Never Overtake US ...Bloomberg

Professor Wen of Renmin University did create a 10 lecture series about how China has actually handled economic crises and development if anyone is interested. He's also worked quite a bit with the esteemed Michael Hudson.

One running theme was that the countryside was the source of both obtaining economic surplus and absorbing extra labour but I think that China is finally getting around to giving back and developing the countryside with its poverty alleviation program.

https://www.youtube.com/playlist?list=PLW2w8_H08pM0eoxrS2cxbwdcCPjPK9A12

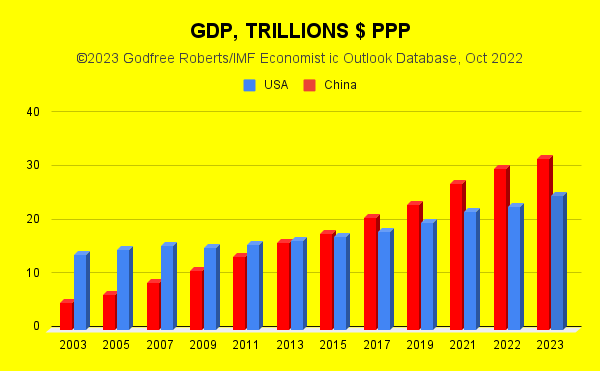

Wages as % of GDP is an interesting metric. So in effect as far as people are concerned China gets a 50% wealth boost on top of PPP.

And PPP understates the real effect too. Some products are priced similarly, some at a PPP ratio to US$ prices and some a lot or even a lot lot cheaper. Those cheap products are often very important. So Chinese and Russian hypersonic missiles are very cheap relative to the nearest US equivalent. That proportion of GDP is working really well for China. Food I would guess is similar. 1000km of high speed railway will also be much cheaper relatively than PPP ratios.

The measure I would like to see is 75% Wealth. I have never seen it calculated, and I guess it would take a lot of effort. 75% Wealth to me would be the Income of the bottom 75% of the population (on the grounds that the top 25% can take care of themselves and any gains for them make little difference to the country as a whole).

My intuition is that 75% Wealth in US has been static or slight negative since the 1980s, and only slightly positive here in UK or much of W Europe.

Russia on the other hand has been sharply growing, and China will have shown quite staggering growth. Indeed it must now be close to catching up to US levels.