When the US Navy reports China having 200 times more shipbuilding capability than the US, the nagging question is: can the US make anything at scale or at a price point that can compete with China? Graham Allison, Douglas Dillon Professor of Government, Harvard University.

The Sterling bloc

Before World War I, Britain’s pound sterling was the world’s most important currency, the City of London was its financial centre, 60% of global trade was financed, invoiced and settled in sterling, and the largest proportion of official reserves, apart from gold, was held in sterling.

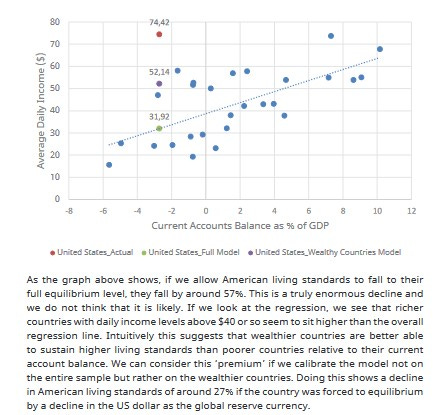

When postwar Britain left the gold standard in 1931 (America followed in 1972), countries that chose to peg their currencies to sterling instead of gold formed the ‘sterling bloc’. Within the bloc, the pound preserved some of the British Empire's superpower status, but bankrupt post-WWII Britain could not defend its exchange value. By 1972, the bloc had dissolved and central banks’ sterling balances reflected Britain’s weight in world trade, as they still do. While the decline greatly pleased Washington, the US Treasury repeatedly rescued the British pound.

The heart-breaking truth

Today – in the alternative universe created by our media and inhabited by our politicians – we must compete with China. To suggest otherwise risks charges of defeatism, even treason.

Of course, that’s just copium.. We cannot compete with a people so numerous, cohesive, intelligent and scientifically advanced. Their government is too competent, their manufacturing too dominant, their economy too strong and their military too powerful for the post-Ukraine West to challenge it. Indeed, if China simply embargoed pharmaceuticals, most American hospitals would cease to function within 90 days.

Rather than admitting these self-evident facts and making necessary reforms, our politicians are erecting an iron curtain that renders cheap Russian energy and advanced Chinese technology inaccessible. In the dollar bloc, the €, CA$, AU$ and £ will be pegged to the US dollar, but behind a wall of tariffs, embargoes, export controls, investment reviews, unilateral sanctions and confiscations, where their economies will continue declining.

The new era

In 2000, eighty percent of countries did more trade with the US than with China and the dollar’s share of global settlements reflected that but America’s share of world trade declined and there are sound reasons for the decline to continue:

It is easier and cheaper for countries to trade in alternative currencies today, especially since China introduced mBridge.

The Fed’s zero-interest rate regime turned central banks away from the dollar in search of secure, stable returns for their assets.

The recent, dramatic rise of America’s public debt and recurring budget disputes damage investor confidence in the US government’s stability.

The relative decline of US exports in global trade.

For the US, a diminishing role of the USD would imply – due to impact of the likely currency devaluation – an increase of exports and a decrease of imports, and the US trade deficit would likely shrink in this new environment. Due to fading demand for US treasuries, financing costs increase, making debt-taking more expensive for the US. Thus, the pressure on US fiscal policy would increase further. Under a multipolar currency system, it would also become harder for the US to exert its power, i.e., to impose effective financial/economic sanctions.

Currencies of the BRICS countries – whose rising share of global trade currently accounts for over 20% – would benefit substantially from a multipolar currency system. Due to appreciation of their currencies, exports would get more expensive. This would likely push prices for commodities for the rest of the world and BRICS imports would become cheaper. Geopolitically, BRICS and RoW would be less vulnerable to US sanctions. Roland Berger

Consider the alternative

Every night I ask myself why all countries have to base their trade on the dollar. Why can’t we do trade based on our own currencies? Who was it that decided that the dollar was the currency after the disappearance of the gold standard? Luiz Inácio Lula da Silva, President of Brazil.

While Washington was determined to replace the £ sterling as the world’s reserve currency after WWII, the US Treasury repeatedly rescued the British pound.

In 2008, during the GFC, China played a crucial role in stabilizing the US dollar by maintaining its peg to the dollar, which helped prevent a more significant depreciation of the currency during the crisis and used its massive current account surplus to purchase US Treasury bonds at very low interest rates. This influx of capital helped to stabilize the US financial system by providing desperately needed liquidity – for which Treasury Secretary Hank Paulson was publicly grateful.

In some respects the next emergency will be GFC 2.0 but its outcome will be completely different, as the dollar’s share of central bank reserves rapidly converges on America’s 8% share of world trade though, contrary to public expectations, the RMB will not replace the dollar. That would require Beijing to provide RMB both for its own economy and the entire world, creating a permanent trade deficit, as it does for the USA. Instead, central banks will trade in their own currencies via mBridge (as my home country, Thailand, does).

Meanwhile Russia and China will put the finishing touches to a synthetic reserve currency based on the ‘bancor’ that Keynes proposed at Bretton Woods in 1945, and which the US rejected.

Expect it by 2030. Naming rights available.