History

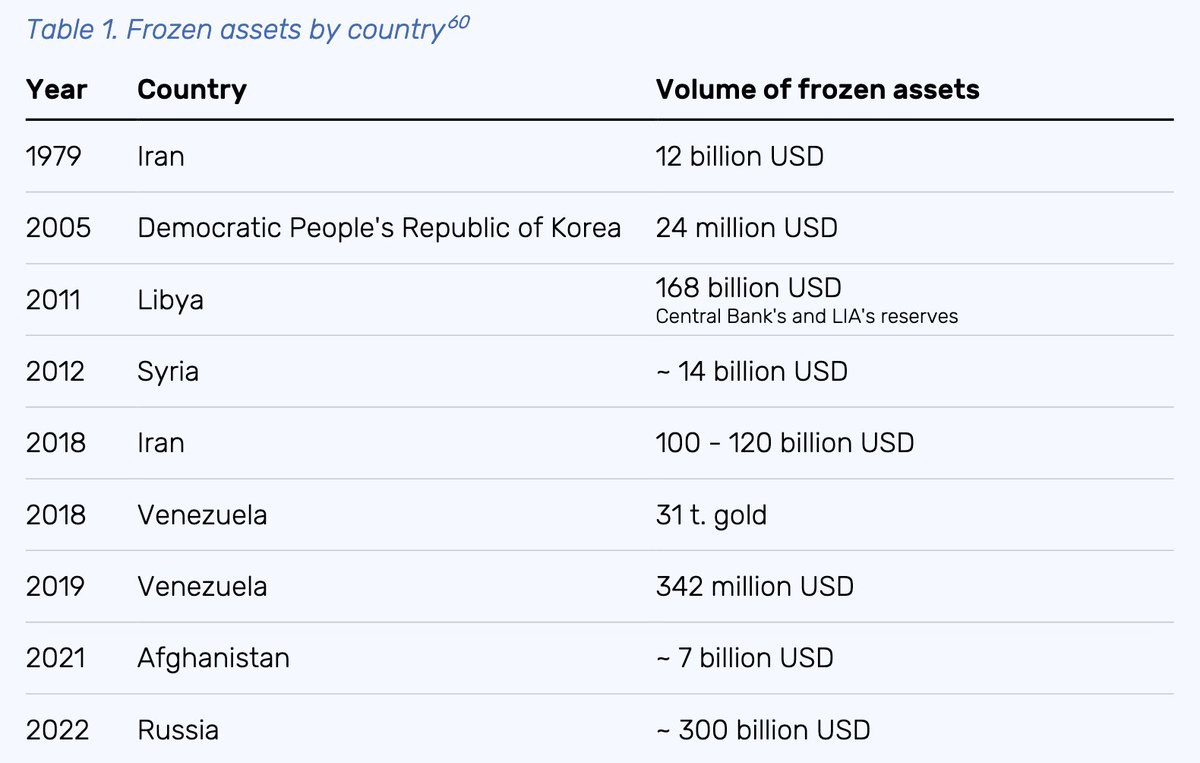

In addition to its partnership with SWIFT, the Patriot Act’s Section 311 gives Treasury the power to label an institution risky in view of suspected money-laundering–vagueness ideal for targeting financial institutions. The U.S. government did not need to freeze assets directly when money-laundering is only suspected, not proved. Private banks are not so constrained. They are free to cease doing business with whomever they choose. Section 311 provided a powerful incentive for banks to do exactly as the Treasury recommends, to offload any entity deemed an institutional risk. In just a few years, the Treasury had moved beyond targeting terrorist suspects to going after financial institutions associated with national governments deemed enemies, to hitting the financial institutions of targeted governments themselves. In 2011, Obama froze $37 billion of Libyan assets—then the largest sequestration of assets in history and the first time these financial sanctions had been used with the explicit intention of toppling a government. Nathan Ponkoski

In October 2009, following the Global Financial Crisis, PBOC Governor Zhou Xiaochuan announced, "The world needs an international reserve currency that is disconnected from individual nations and able to remain stable in the long run, removing the inherent deficiencies caused by using credit-based national currencies.”

In October, 2024, Governor Zhou explained, “mBridge (below) complements rather than excludes US dollar use. It does not exclude the use of the dollar and will focus on facilitating payments for small-amount current account transactions. mBridge, in fact, is primarily aimed at filling in the vacancies in the international payment system1.

Whether the US dollar maintains its status as a reserve and an international trade settlement currency is very much up to the US government itself. Traditionally, "hard currencies" have been used in cross-border payments, but that cannot fully satisfy the demand in Asia in recent years amid the region's fast development of interconnections, giving rise to the growth of mBridge and other platforms to facilitate cross-border payments within the region. Demand drives mBridge, particularly from the large cooperation scope among ASEAN, China and the Gulf states. mBridge should first facilitate the payments and settlements of current account transactions, especially small-amount ones. This aligns well with the demand of Asian economies in terms of economic, trade and travel development.

We appreciate very much Swift’s provision of its global communication facility and successful promotion of international trade connection for many years and hope that Swift can maintain neutrality in business and governance and provide continuous, outstanding services for interbank communication”.

In November, 2024, under pressure from the US, BIS, the Bank for International Settlements, withdrew from mBridge, “Whatever projects we put together should not be a conduit to violate sanctions”. This may prevent integration with SWIFT.

In November, 2024, Iran and Russia have completely integrated their national payment systems. Russia's Mir is now officially connected to Iran's Shetab, so Shetab cards can use Russian ATMs. Next, Russian tourists will be able to use their Mir cards in Iran. Finally, Iranian citizens will be able to use their Shetab cards to pay for goods and services in Russia.

Consequences

Layoffs at John Deere blow up investment thesis on food shortages; US farmland to see liquidation. Because mBridge:

In October, 2023, 150 countries convened in Kazan, Russia to formally adopt a new, global, digital platform that allows them to trade with each other in their own currencies.

First step

The PBOC’s first step was creating the e-Yuan, the world’s first major central bank digital currency, or CBDC, and release it in the Spring of 2021. Public servants who elected to be paid in the traceable currency we celebrated and the wild rumpus began.

Fast forward to Fall, 2024, and industrial enterprises, fintechs, commercial banks and start-ups are relocating to Shenzen’s e-Yuan industrial park, attracted by grants and loans up to $7 million and three years’ free rent. To encourage new CBDC use cases and boost the development of the digital economy across industries, Beijing kicked in $14 million for digital RMB computing, algorithms and digital economy data.

Today, Chinese visitors to Singapore use e-yuan and increasing integration between the digital yuan and Hong Kong enables visitors in both directions to use the CBDC. Last week, PetroChina bought one million barrels of crude oil and settled in e-CNY, at the Shanghai Petroleum and Natural Gas Exchange (SHPGX) ..and that’s where the story gets interesting.

This week, says Lawrence Awuku-Boateng, “The central bank of Ghana is cooperating with the Russian central bank and we plan to conduct trade settlements in national currencies through a bank in China. This greatly simplifies the process”.

Enter mBridge

Cross-border payments, now dominated by the US dollar, will reach $250 trillion by 2027, up $100 trillion in one decade. There’s just no stopping it. The trouble is that international payments are slow and costly, and Washington’s ‘long-arm’ jurisdiction over all dollar transactions has politicized trade. So the PBOC and Basle’s Bank for International Settlements came up with the mBridge digital interbank payment system. It instantly converts yuan payments and credits dirham to the vendor’s UAE bank account. With an execution time of 6-8 ms. and 2.2¢ transaction cost mBridge brings Beijing’s goal of frictionless trade a giant step closer.

Best of all, no US regulators or dollars are involved.

Cause for concern?

The PBOC (the world’s richest central bank, with $3-$5 trillion in foreign reserves2), the HK Monetary Authority, the Royal Bank of Thailand and the UAE Central Bank have been trading with mBridge for two years, and BRICS members were told that they could join next January, further eroding the usefulness of the dollar as a reserve asset.

Putting $3 trillion to work

A billion dollars is a thousand million dollars. A trillion dollars is a thousand billion dollars, and the PBOC has $3.3 trillion-$5 trillion of them, far more than it could possibly use. As we saw, above, Beijing uses some of that stash to pay off friendly countries’ old dollar loans for new RMB loans but, as trade with the West declines and the dollar’s future looks shakier, it must put that money to use. Kevin Walmsley explains one way they are doing that: Tether.

Says Kevin: “As we know, China is pushing Hong Kong as a global hub for Stablecoins, which are digital currencies backed by fiat money. Western analysts correctly point out that China, uniquely among large economies, is aggressively building out the financial infrastructure and regulation for digital currencies issued by central banks. But these analyses err on a major point: the stablecoins issued by Hong Kong institutions will not be China-yuan denominated, as they assume. Instead, they will be denominated in US dollars, and will be a powerful driver of economic growth to the benefit of the Chinese financial system, and without exposing their own currency to outside speculators, seizure, or debt issuance.

“To see how this may play out, consider the explosive growth of Tether, a stablecoin with stated US dollar reserves of $116 billion and 1-to-1 parity with the US dollar. The sudden rise and global acceptance of Tether serve as a playbook for Chinese banking regulators, who hope to deploy these deep capital pools but without exposure to the Western banking system”.

October, 2024

“mBridge does not exclude the use of the dollar and will focus on facilitating payments for small-amount current account transactions”, said Zhou Xiaochuan, former PBOC governor. mBridge, in fact, is primarily aimed at filling in the gaps in the international payment system, and developments will depend on efficiency, cost, security and user choice. "Whether the US dollar may maintain as a reserve currency and an international trade settlement currency is very much on the US government itself".

Further Reading

Tether's $100 billion stokes stablecoin stability concerns

Tether’s Ascent: Breaking Down the Dominant Stablecoin's Growth

The House Bans The Fed From Building A CBDC Like The Digital Yuan

What and where are Russia's $300 billion in reserves frozen in the West?

China contends for the central position in the global economy

At a Financial Street Forum event titled "Project mBridge: Bridging Global Economies with Central Bank Digital Currencies".

Brad Setser, foreign currency advisor to President Obama, says that, in addition to the PBOC’s declared $3 tn., it has stashed at least $2 tn. in regional bank vaults.