For years, China warned Washington that weaponising the global technology supply chain would have serious consequences. Quietly, consistently, and with remarkable restraint, Beijing issued statements, offered backchannel admonitions, and gently signaled that Washington’s escalation would not go unanswered. But Washington didn’t listen. Perhaps it couldn’t. The problem is not that the signs weren’t there, but because hubris and a racialised worldview rendered U.S. policymakers deaf to non-Western strategic reasoning and the subtle language of diplomatise. When Beijing spoke in the calm and coded language of diplomacy, without resort to hyperbole, it was interpreted not as resolve, but as retreat. As usual, restraint was mistaken for weakness. Warwick Powell

Officials in the Biden administration were so concerned about the U.S. military’s lack of a domestic samarium supply that they issued large contracts for the construction of two samarium production facilities. Neither was built because of commercial concerns, leaving the United States entirely dependent on China. NYT.

The Saudi Arabia of Rare Earths

Premier Li

Worldwide, annual sales of rare earths total just $5 billion, minuscule compared with $300 billion for copper or iron ore mining. Even worse, extracting rare earth minerals is a dirty, tiresome, environmentally fraught process, but turning the ore (dirt) into laboratory grade, high-purity metals and alloys entails intellectual property that only China possesses. And there’s something else China possesses: manpower.

Geologists galore

Rare earth chemistry programs are offered in 39 universities across the country, while the United States has no similar programs. China graduates 30,000 geologists each year, 3,000 of whom are PhDs, giving it a total of 500,000 active geologists1 and 60,000 PhDs2. The China University of Geosciences alone graduates 10,000 geologists annually.

State-Owned Enterprises (SOEs): ~200,000 (e.g., Sinopec, CNPC, China Minmetals).

Academic/Research Institutions: ~150,000 (e.g., Chinese Academy of Geological Sciences, universities).

Private Sector: ~150,000 (mining, environmental consulting, etc.).

2. Geologists with PhDs

PhD Holders: ~50,000–60,000 (~10–12% of total geologists).

Breakdown:

Petroleum/Energy: ~15,000 (e.g., China National Petroleum Corporation).

Mining/REEs: ~12,000 (key for rare earth and lithium extraction).

Academia/Government: ~20,000 (research institutes, policy roles).

Environmental Geology: ~3,000–5,000.

3. Training Pipeline

Annual Geology Graduates: ~30,000 (BSc/MSc) and ~3,000 PhDs.

Top Programs:

China University of Geosciences (Wuhan/Beijing).

Peking University, Nanjing University.

Focus Areas:

Critical Minerals: Rare earths, lithium, cobalt.

Oil/Gas: Shale exploration, deep-sea drilling.

Geotechnical Engineering: Belt and Road infrastructure projects.

4. Global Comparison

United States: ~80,000 geologists (~25,000 PhDs).

EU: ~120,000 geologists (~30,000 PhDs).

China’s Edge: 5x more geologists than the U.S., with heavy state investment in strategic minerals.

5. Why This Matters

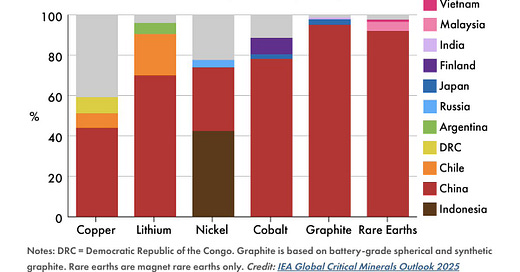

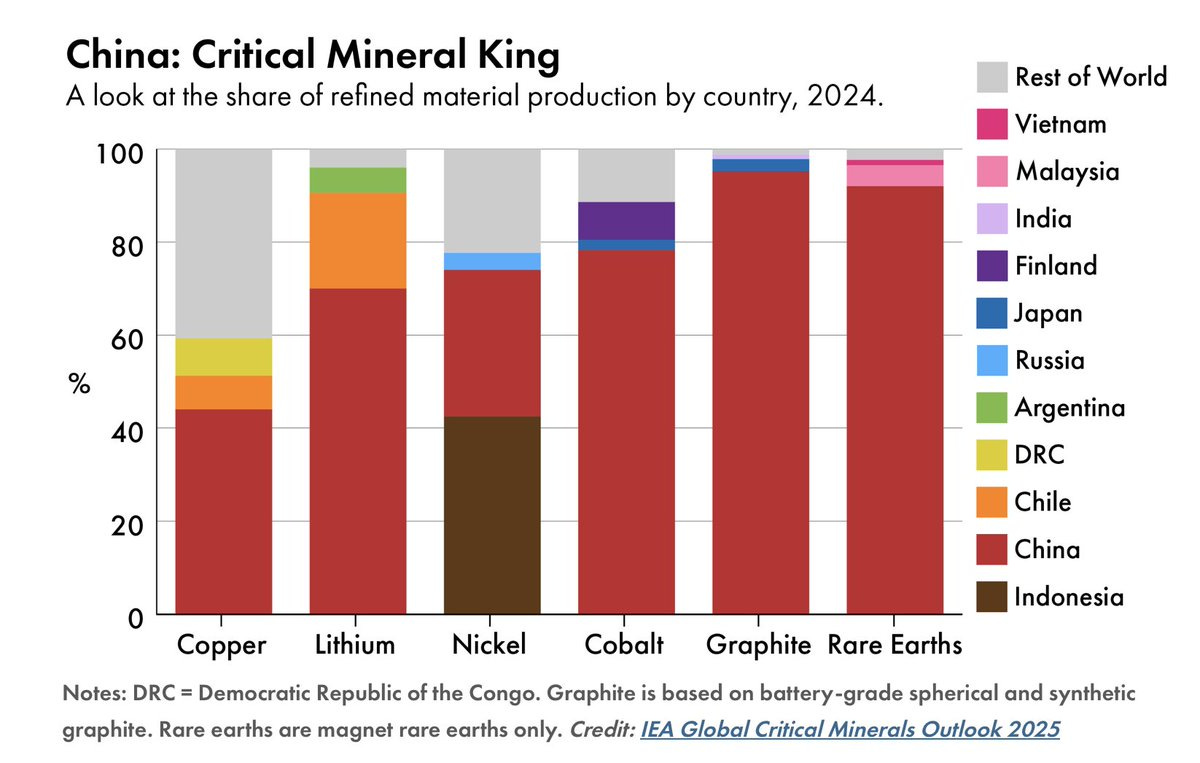

Resource Dominance: China controls 60% of global REE production and 80% of processing—geologists enable this.

Belt and Road: Thousands of Chinese geologists work overseas (Africa, Latin America) to secure mineral supplies.

Innovation:

Impact on U.S. Factories:

Integrated Supply Chain Technologies:

Description: China’s IP extends to vertically integrated supply chain technologies, from mining to finished products. This includes proprietary systems for ore beneficiation, smelting, and the production of high-value products like alloys and electronic components.

IP Scope: China’s patents cover integrated systems for tracking and optimizing REE production, such as the rare earth product traceability information system mandated by regulations effective October 1, 2024. These systems ensure state control over resources and enhance efficiency, giving China a competitive edge.

Impact on U.S. Factories: U.S. factories, particularly in tech and defense, lack access to such integrated systems, making it harder to compete with China’s cost-effective production. For instance, semiconductor manufacturers (e.g., those supplying Apple) face disruptions due to restricted access to processed REEs like gadolinium, critical for chip production. The absence of equivalent IP hinders U.S. efforts to build a self-sufficient supply chain.

National Rare Earth Laboratories and R&D:

Description: China operates five well-funded National Rare Earth Laboratories, established under initiatives like the Super 863 Program, which focus on developing cutting-edge REE technologies. These labs have driven innovations in extraction, separation, and application, outpacing the U.S., which has only one intermittently active lab (Ames National Laboratory).

IP Scope: These labs have produced thousands of patents, including those for advanced extraction techniques and novel REE applications in AI and defense technologies. For example, Xu Guangxian, a pioneer in China’s REE industry, led efforts to secure core patents that underpin China’s processing dominance.

Impact on U.S. Factories: The technological gap means U.S. factories cannot quickly replicate China’s processing capabilities. For example, MP Materials’ Mountain Pass mine still sends ore to China for advanced processing due to insufficient domestic IP and infrastructure, leaving industries like medical imaging (e.g., MRI scanners) vulnerable to supply disruptions.

Broader Implications for U.S. Factories

China’s extensive REE IP, combined with its export restrictions, creates significant challenges for U.S. factories:

Defense and Aerospace: Companies like Lockheed Martin and Boeing, reliant on REEs for radar systems and missiles, face risks of production delays as China’s licensing system delays exports. The U.S. Department of Defense’s goal of an independent REE supply chain by 2027 is hindered by the lack of comparable IP.

Automotive and Tech: Factories producing electric vehicles (e.g., Tesla) and consumer electronics (e.g., Apple) are impacted by restricted access to magnets and processed REEs. China’s IP in magnet production and processing means U.S. firms cannot easily substitute with domestic alternatives, leading to potential cost increases and supply chain bottlenecks.

Healthcare: Manufacturers of MRI scanners and cancer treatment devices depend on REEs like gadolinium and yttrium, which are subject to export controls. Without access to China’s advanced processing IP, U.S. factories face challenges in securing stable supplies.

Economic Impact: A U.S. Geological Survey report estimates that a total ban on certain critical minerals could result in a $3.4 billion GDP loss, with REE restrictions contributing significantly due to their role in high-tech manufacturing.

Efforts to Mitigate Impact

U.S. factories are responding by:

Seeking Alternative Suppliers: Some are sourcing from Australia (e.g., Lynas) or exploring deposits in Brazil and Vietnam, though these countries lack China’s processing IP and capacity.

Recycling Initiatives: Startups like Phoenix Tailings aim to recycle REEs, but their technologies are not yet at commercial scale and lack the efficiency of China’s patented methods.

Domestic Investment: The U.S. has invested over $439 million since 2020 to build REE supply chains, but projects like MP Materials’ Fort Worth facility and USA Rare Earths’ Texas operations are years from matching China’s output due to IP and infrastructure gaps.

Conclusion

China’s significant IP in solvent extraction, magnet production, green recycling, and integrated supply chain technologies underpins its 90% control of global REE processing and 94% of magnet production. This IP advantage exacerbates the impact of its export restrictions on U.S. factories, particularly in defense, automotive, tech, and healthcare sectors, which face supply shortages and rising costs. While the U.S. is investing in domestic capabilities, the lack of comparable IP means it will take 5–10 years to close the gap, leaving factories vulnerable in the interim. Diversifying supply chains and accelerating R&D are critical to reducing dependence on China’s IP and mitigating ongoing disruptions

What U.S. investors will finance production of factories in an industry that will never produce profits in competition with China? State-managed Socialism outperforms Capitalism when long-term investments are required.

Including field geologists, researchers, and industry professionals

Of America’s 80,000 geologists, 25,000 have PhDs.

What is the current situation? Has China now backed off blocking all except samarium?

Fascinating and sobering read. The combination of China's intellectual property, state-backed integration, and vast geoscientific manpower gives it a nearly unassailable lead in rare earths. One question: Can the U.S. realistically build a competitive REE ecosystem without abandoning free-market orthodoxy?